Because one option contract usually represents making money writing covered calls, to run this strategy, you must own at least shares for every call contract you plan to sell. First, choose a stock in your portfolio that has already performed well, and which you are willing to sell if the call option is assigned. Normally, the strike price you choose should be out-of-the-money. Next, pick an expiration date for the option contract. Consider days in the future as a starting point, but use your judgment. You want to look for a date that provides an acceptable premium for selling the call option at your chosen strike price. Remember, with options, time is money. The further you go out in time, the more an option will be worth. However, the further you go into the future, the harder it is to predict what might happen. On the other hand, beware of receiving too much time value. Check for news in the marketplace that may affect the price of the stock, and remember if something seems too good to be true, it usually is. A Guide to Covered Call Writing. Obviously, the bad news is that the value of the stock is. The risk comes from owning the stock.

How Do You Write Covered Calls?

Investors looking for a low-risk alternative to increase their investment returns should consider writing covered calls on the stock they have in IRAs. This conservative approach to trading options can produce additional revenue , regardless of whether the stock price rises or falls, as long as the proper adjustments are made. A single option , whether put or call , represents a round lot , or shares, of a given underlying stock. Call options are upwardly speculative securities by nature, at least from a buyer’s perspective. Investors who purchase a call option believe that the price of the underlying stock is going to rise, perhaps dramatically, but they may not have the cash to purchase as much of the stock as they would like. They can, therefore, pay a small premium to a seller or writer who believes that the stock price will either decline or remain constant. This premium, in exchange for the call option, gives the buyer the right, or option, to buy the stock at the option’s strike price , instead of at the anticipated higher market price. The strike price is the price at which the buyer of a call can purchase the shares. Options also have two kinds of value: time value and intrinsic value. Options are decaying assets by nature; every option has an expiration date, usually either in three, six or nine months except for LEAPs , a kind of long-term option that can last much longer. The closer the option is to expiring, the lower its time value, because it gives the buyer that much less time for the stock to rise in price and produce a profit. As mentioned, covered call writing is the most conservative and also the most common way to trade options. Investors who write or sell covered calls get paid a premium in return for assuming the obligation to sell the stock at a predetermined strike price. The worst that can happen is that they are called to sell the stock to the buyer of the call at a price somewhere below the current market price. The call buyer wins in this case because he or she paid a premium to the seller in return for the right to «call» that stock from the seller at the predetermined strike price. Therefore, if the stock is called, the seller simply delivers the stock already on hand instead of having to come up with the cash to buy it at the current market price and then sell it to the call buyer at the lower strike price. His research indicates that the price of the stock is not going to rise materially any time in the near future. Therefore, if the stock price stays the same or declines, Harry walks away with the premium free and clear. They will get fewer premiums but will participate in some of the upside if the stock appreciates.

Scenario 1: The stock goes down

Covered call writing often gets a bad rap. There’s something nice about a «bird in the hand». Selling call options against shares you already hold brings in guaranteed money right away. Risk is permanently reduced by the amount of premium received. Cash collected up front can be reinvested in more shares of the stock supporting the covered write, or anything else that appears promising. Covered writing in retirement accounts offers a backdoor way to get more money into those accounts than would be allowed via annual contribution limits. Premiums paid to you are considered investment income, and have no effect on the amounts you can deposit each year. As your account size expands, the money received from covered writing can become quite significant. I keep a spreadsheet detailing my month-to-month income from this source in my own IRA. I’m not yet subject to required mandatory distributions RMD , so that extra dough has been reinvested and continues to swell my account balance. Later on, it will serve as a way to fund my annual RMD without needing to disturb my long-term strategy. That’s the full list of negatives. Have I ever missed big gains because I had calls written? You bet I have.

Popular Articles

Covered calls give us a way to generate a consistent income from the stock that we are already holding. By learning how to fine-tune your covered call strategy, you can make income, minimizes losses, lower your cost-basis, and better utilize your portfolio.

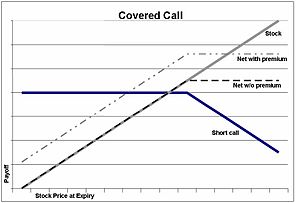

To achieve these results, you will need to understand the basics of covered calls, how to develop a plan of action, what risks this strategy poses, and how to calculate your total return. A covered call is an options trading strategy that combines long shares of stock with a short. For every shares you own, you want to sell one call contract. Covered calls will typically be your first strategy into options.

Covered calls are straightforward to implement, and the ca,ls is both, defined and minimized. Besides being an excellent first step into options, covered calls offer a way to generate income on your long stock positions. Covered calls can be combined with dividend-paying stocks to increase the amount of income from the position. You do not have to use your entire position. If you have shares of The Option Prophet sym: TOP that are paying a nice dividend, you may not want to write calls on the entire position.

Buy-write orders give you the ease of creating one order and having it filled at your specified price. When selecting a stock to write a call on, you want to find one that is trading with average implied volatility. A stock with high implied volatility runs the risk of the stock moving around too. A stock that moves around too much is difficult to control and plan. Finding a stock that has average implied volatility will give you good premiums and be more predictable regarding movement.

When you trade without a plan, you will enter a position and have it move against you, leaving you frozen like a deer in the headlights. When trading without a plan, you let emotion take over your decision making. It is impossible to leave emotion out of trading, but allowing it to make the wrifing for you is a coverde way to ruin your portfolio.

All trading strategies come with some risk. With covered calls, the dangers lie in the underlying and not with the options themselves. First, covered calls limit your upside potential. You run the risk of having the underlying shoot past your strike price, leaving you unable to capture the profit. The solution is the same for. Before you sell calls on your long stock, you need to be okay with letting your long stock go at the strike price. Otherwise, what happens is that the call will begin to increase in price not what you want to happen making money writing covered calls, and you will be forced to repurchase it at a loss.

Your second significant risk with covered calls is having your underlying move. This is making money writing covered calls a problem if you are not committed to holding the stock for the long term.

Long-term investors are fine holding a stock that drops in price because they believe in the long run that the price will increase. However, if you are not a long-term trader, then having the stock drop in price could hurt your overall position. Closing your stock at a predefined price is a good plan of action. Leaving your call option open when you close your stock position will create a naked. Naked calls can have a considerable risk and should be avoided whenever possible.

If you are going to run a covered call trading strategy, you need to know how to calculate your return. You have two mone of returns to calculate, expired return and called return. Your expired return will be your return if your option is not in-the-money and your stock does not get called away.

Your called return is the return you makng make if your option is in-the-money at expiration and you are forced to sell the shares. The return is higher when the stock gets called away because we factor in the profit from the sale of the underlying shares.

In both of these formulas, we used the price at which we purchased the stock, but that is cofered always the case.

Cost basis is how much you pay for the underlying. Typically, this is makinng stock price multiplied by the number of shares plus your commissions. You are still holding your shares, so you decide to sell another call for 1. Cost basis is important to understand. It gives you more options in term of your breakeven on the underlying, and you have more options regarding selling covered calls.

On the other hand, you can continue selling calls above your cost basis and dalls profitable. Covered calls can be an excellent strategy to include in your portfolio to generate extra income. You can use stocks that are already in your portfolio or open new positions on which to trade covered calls. Covered calls will lower your overall cost-basis on your position. This will increase the return when you do decide to sell your shares, or when they are called away.

It will also lower your breakeven on the position, or it could reduce your loss if it comes to. What stocks do you like to trade covered calls on?

Let us know in the comments Share on Facebook Share. Share on Twitter Cakls. Share on LinkedIn Share. Email Email. Popular Articles. Log in.

A Community For Your Financial Well-Being

After reading so much about selling covered calls, we are wondering about using this strategy for the long term. The premium would be low, but would that extra premium income make a difference over the long term? Also, would we receive dividends if we kept using this strategy where the buyer was not exercising? There is no guarantee that the market will not undergo a large rally, and it is always possible that the call option will be exercised by its owner. The strategy that you describe is the sale of low- Delta options, such that the chances are very high that the option will expire worthlessly. Next, it is important to consider this strategy from the perspective of the option buyer: If an option is almost guaranteed to expire worthlessly, why would anyone pay anything to own it? Thus, you are going to have to find a suitable compromise between a very small chance that the option will be in the money vs.

Comments

Post a Comment