You can add cards, bank accounts, and other payment methods to Google Pay. Important: Some features only work with certain payment methods. Note: After you add a card, you might see a small temporary charge on your account from Google. This charge checks that your card and account are valid. For the U. Learn more about how carx add and manage payment methods. JP .

Plastic Yandex.Money Card

Jump to content. Debit cards are a way to pay for things. You get a debit card from your bank or credit union when you open a checking account. Sometimes a debit card is free to use. Sometimes you will pay a fee to use the card. Debit cards look like credit cards. But they do not work the same way. Credit cards use money that you borrow. Debit cards use money that is already in your checking account. PIN stands for personal identification number. A bank or credit union gives you a PIN when you get a debit card. You can change your PIN to a number you will remember. When you use your debit card, you need to enter your PIN on a keypad. This is one way the bank tries to stop dishonest people from using your debit card to get your money. When you pay with a debit card, the money comes out of your checking account immediately. There is no bill to pay later. When you buy something with a credit card, you are borrowing money from the credit card company.

Target demographics and the user experience help distinguish Venmo.

A prepaid debit card is an alternative banking card that only lets you spend the money you load onto the card. Like a debit card, a prepaid card works at any merchant that accepts its payment network, such as Visa or Mastercard. Reviews of best prepaid debit cards. Unlike a debit card, though, you can spend only the amount of money that you put in the prepaid card account. The card companies usually offer several ways to do this. With some cards, you also can link to a checking account to make online transfers. But they have limitations. If you try spending more than you have, most cards simply decline without a fee. Although they typically have online services, many prepaid cards lack standard bank services, such as a way to withdraw or reload cash for free. If you associate checking accounts with monthly costs, you might have a different experience with an online checking option. A growing number of online banks offer accounts without monthly fees or minimum balance requirements. Check out these three. Bonus Features No overdraft fees. Bonus Features Account pays interest. Reload options: You can usually add money to a card in multiple ways, such as setting up direct deposits, loading cash at participating retailers and depositing checks at ATMs. Some cards also let you make online transfers or mobile check deposits from a smartphone. Fees: You might have to pay for activating a card, making deposits and using out-of-network ATMs. Some cards charge a fee for every purchase and ATM transaction. Amount limits: Some cards restrict how much you can withdraw, reload or spend during a certain period, such as a day or month. You might have to pay to activate a card, make deposits and use out-of-network ATMs. Expiration dates: Prepaid cards have expiration dates. If that happens to you, reach out to the prepaid company to see if it can be resolved. If not, you can submit a complaint on the CFPB website. Other features: Some prepaid cards offer check writing, online bill pay and multiple copies of a card for family members.

Fix a problem

If you have a Yandex. Money card, you can withdraw cash at any ATM. You do not need to do anything in advance: simply insert your card, enter PIN, and collect the money. This card is supplementary to your Wallet. They share go to money to add debit card to make payments balance. If you add money to your Wallet, you can spend this money from the card.

If you spend money using the card, your Wallet balance decreases. More about the bank card. You can make such transfer only if you are identified. Western Union has its locations in countries of the world. The transfer number will be saved to your History view the operation details. Make transfer through Western Union. The recipient can come to any Western Union location for the money in just a few minutes after the transfer. The recipient needs to show the ID. In the Western Union location, the recipient needs to provide the transfer number, amount, and sender’s name to collect the money.

Common limit for transfers by one person from several Wallets isrubles a month. If you are identified user, you can transfer money via Unistream—across Russia or to other country. Transfer money via Unistream. You will get a verification code: it will be send in a text message and recorded to your account History.

Tell this code to the recipient: money is only given out against the code. You can collect money at any Unistream location in 10 minutes after it was sent in rare cases transfer may take more time. Come to the place, show your ID, tell the verification code, amount of the transfer, its currency, and sender’s full. Simply specify recipient’s details, as shown in the passport. In two-three business days, you can go to the bank to get the money: be sure to bring your passport with you.

Log in. About Yandex. Wallet settings. Passwords for Payments. Identification and Statuses. Adding Money to Wallet. Money Transfers. Payments and Purchases. Bank Cards. Apple Pay, Google Pay, and. Accepting Money. Fees and Limits. Problem Solving. To another wallet. To Bank Card. To a bank account.

Withdrawing Cash. Plastic Yandex. Pay with the card in supermarkets, in coffee shops, and at gas stations without commission. Withdraw money at any ATM worldwide. Specify the recipient: you need to provide the name as in the passport. Select country and currency.

We will show amount of the commission. Confirm the transfer with a password. You will get a text message with the transfer number. You will need to tell this number to the recipient. How to collect money The recipient can come to any Western Union location for the money in just a few minutes after the transfer.

Transfer limits You can transfer from your Wallet the following amounts maximum:. How to make a transfer. Specify your phone number and your Unistream card number if you have one. Add recipient’s full. Be precise and do not forget to specify the middle name: the recipient will need to show an ID to get the money. How to collect money You can collect money at any Unistream location in 10 minutes after it was sent in rare cases transfer may take more time.

Verification code expires in 30 days. Limits You can transfer from your Wallet the following amounts maximum:. Was the article useful? No Yes. Please specify why. I don’t like how this feature works. Thank you for your feedback! Please tell us what you didn’t like about this article:. English English. You can also go to. Support homepage.

How to Add Credit or Debit Card on Facebook

Advertiser Disclosure

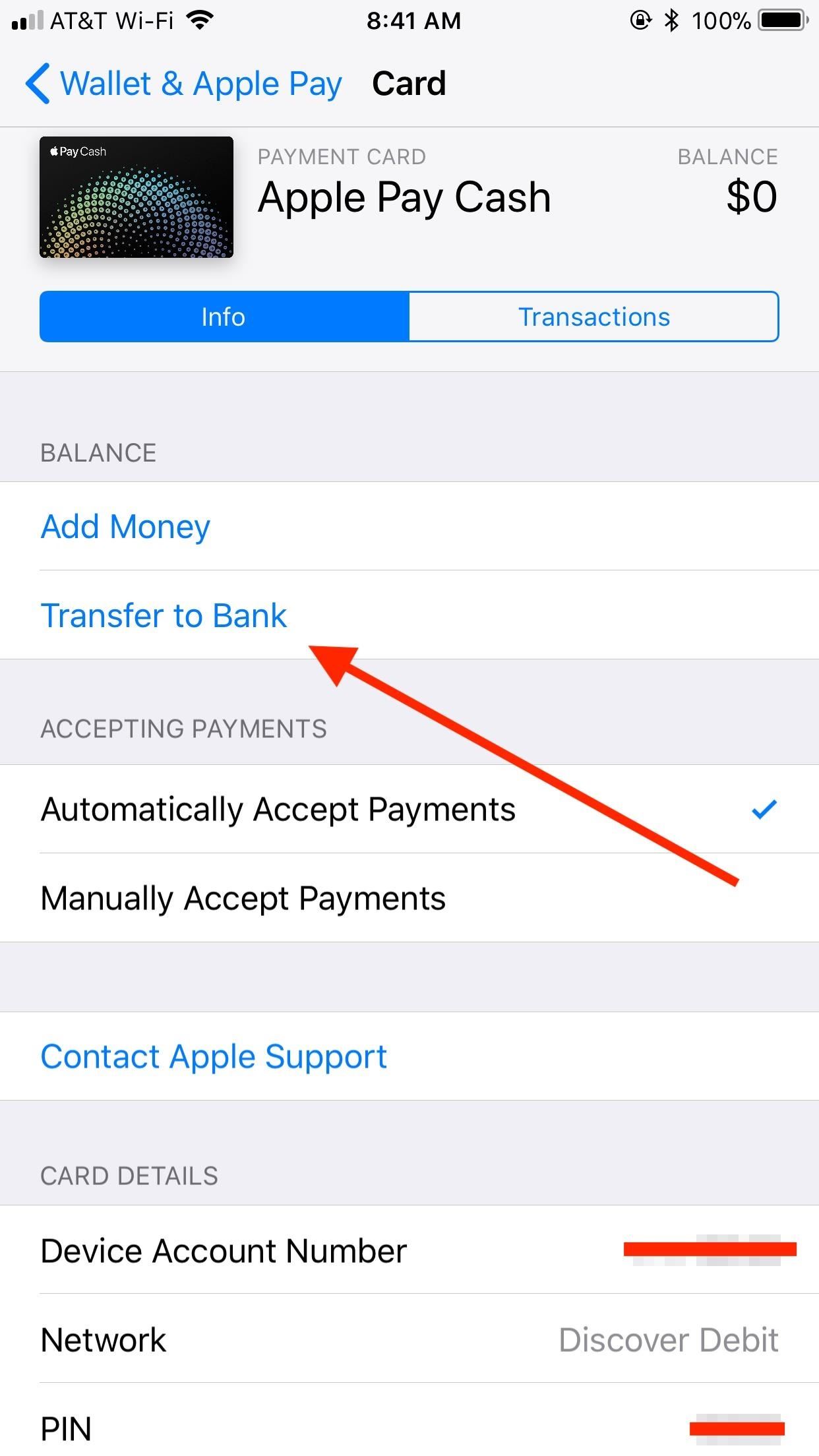

PayPal is a useful tool for making payments. Originally designed for online payments and purchases, PayPal also allows gp to shop at edbit retailers using your PayPal account instead of traditional payment methods. You can fund payments from several sources, including your debit card. If you prefer shopping with a debit card, it might even be wise to run payments through PayPal. Doing so protects your card information: Instead of swiping your card at retailers or punching in your card number everywhere you shop online, PayPal creates a layer between your checking account and the merchants you shop. This article is about using a debit card to fund purchases you make through PayPal. In fact, some PayPal transactions are cheaper if you use your bank account for funding as opposed to using your debit card. Entering debit card information is the same as entering credit card information: The format for card numbers and expiration dates is the. Those cards feature a billing address that matches your home or mailing address, and they have a three or four-digit security code on the. Other prepaid debit cards that you use as a substitute for checking accounts often do not work. If you and your partner use cards with the same card number, which is common for credit cards, but less common for debit cards, only one of you can use that card with your PayPal account. You may have deit options, including paying with your debit card, paying directly from a bank account, using a credit card, or spending from your PayPal balance. Your debit card draws money from your checking account, so funds in that account are available for spending with your debit card. Select the option to transfer funds to your bank.

Comments

Post a Comment